On July 13, US Eastern time, ADI, a well-known analog IC manufacturer, announced that it had reached a final agreement with maxim, which would purchase the company in the form of an all stock transaction of US $20.91 billion. The acquisition is ADI's largest acquisition, with a market value of more than $68 billion. Like other acquisitions, the deal is subject to regulatory scrutiny. The two companies hope to complete the acquisition by next summer.

(source:ADI)

According to the agreement, ADI will buy American credit through an all stock transaction. After the acquisition, the existing shareholders of ADI will own about 69% of the shares of the merged company, and the shareholders of American trust will own about 31% of the shares. In terms of the amount of merger and acquisition, the amount of acquisition agreed by the two companies was $20.91 billion, more than the previous media report of $17 billion. With such a large amount of transaction, ADI's acquisition of SMIC will undoubtedly become one of the largest M & A cases in the history of semiconductor industry.

So what is the significance of the acquisition of SMIC for ADI? The most obvious is that ADI can shorten the gap with Ti, the largest analog chip manufacturer.

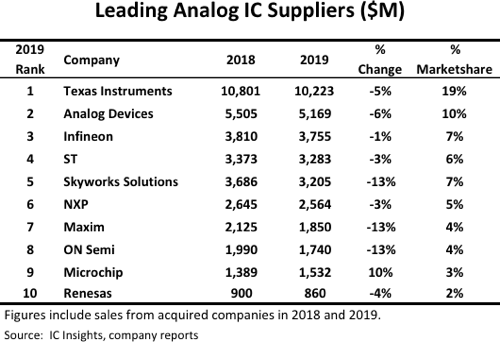

According to the data report of IC insights, an industry research organization, ADI is the second largest analog IC supplier in the world, accounting for 10% of the market share. American trust ranks seventh with a market share of 4%. It can be seen that the current market share of ADI will jump from 10% to 14% after the successful acquisition of Citi, thus greatly narrowing the gap with Ti.

Through the acquisition of Meixin, ADI can strengthen its competitiveness in automobile, industrial control and other fields, especially its deep accumulation in the field of power management IC, and help ADI improve its product line of consumer electronics, thus challenging Ti in an all-round way.

In addition to catching up with Ti, the merger of ADI and Meixin also means 'newspaper group heating' under the current industrial situation to weaken the influence of negative factors.

From the statistics of IC insights, we can see that the sales of the top 10 analog IC factories decreased to varying degrees except microchip. Among them, ADI declined by 6%, and American trust fell by 13%, which was the most severe among the top 10 analog IC plants. This year, the new crown epidemic and the Huawei incident have put greater pressure on the analog IC market, which creates conditions for the merger of ADI and Meixin.

As a matter of fact, as early as 2015, ADI had the intention to purchase American credit, but at that time, the two companies did not reach a consensus on the price, and the acquisition failed. In 2016, ADI expanded by acquiring linear. After three years, the product line of linglilte has been almost integrated. ADI finally took over Meixin, which can be described as 'achieved'.

As for American credit, it has been under the 'rumors' of being acquired in recent years. After the first attempt of ADI in 2015, Ti in 2016 and Renesas in 2018 also announced that they would buy American credit, but they all failed.

The acquisition of Citi by Adi this time can be described as triumphant. It can not only create actual pressure on Ti, which is the first in the industry, but also consolidate the existing achievements in the low tide period of the industry, which can be described as killing two birds with one stone. As for whether the combination of the two companies can achieve the effect of '1 + 1 > 2', it will become the focus of the industry.